£5,000 Or More In Debt? Find Out If We Can Help!

In 2023, 1000’s people wrote off unaffordable debt by entering into an approved debt scheme that could potentially help you Write off % of your existing debts!

Free Expert Help

Reduce your debts and take back control

Some Solutions Can Include:

- Unaffordable Debt Written Off

- Freeze All Interest & Charges on All Debts Included

- Will Not Effect Your Car Or Finance

- Stop All Contact From Creditors and Bailiffs

- Pay One Affordable Monthly Payment

- Stop Debt Related Stress & Anxiety

- Confidential and No Obligation Service

- No Upfront Set Up Fees

- Non-Judgmental Service

Our partners will help you take back control of your finances

Let’s Get Started

“Debt is like any other trap, easy enough to get into, but hard enough to get out of.”

Get Help With Most Types Of Debt, Including

Store Cards

Credit Cards

Personal Loans

![]()

Overdraft

Catalogues

Payday Loans

Council Tax

![]()

Utility Arrears

Debt Collectors

Free Debt Help

Our partners can help you become debt-free by consolidating all your debts into one affordable monthly payment.

This could enable you to stop all creditor contact: no more letters, emails or phone calls.

Free Debt Help

Our partners can help you become debt-free by consolidating all your debts into one affordable monthly payment.

This enables you to stop all creditor contact. No more letters, emails or phone calls.

The Process In 3 Easy Steps

STEP - 1 Eligibility Check

Fill out the form above so we can understand your circumstances.

STEP - 2 Debt Consultation

Speak to a friendly partner for advice to help you choose the best solution for your needs.

STEP - 3 Review & Relax

Let them handle everything so you can free yourself of the worry of speaking to your creditors.

We Understand That Every Situation Is Different

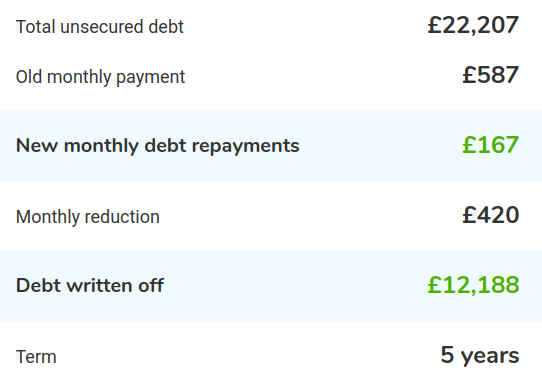

Here’s a breakdown of Tim’s story, who choose an IVA as his best solution.

Alternative solutions may be more suitable for your situation and May not be suitable in all circumstances.

How Does It All Work?

You make one affordable monthly payment

The payment is then distributed between your creditors.

Some solutions mean that at the end of the term, unaffordable debt is written off.

Understanding The Best Solutions To Consider

Debt Management Plan

Individual Voluntary Arrangement

Debt Relief Order

DRO

Is a way to have your debts written off if you have a relatively low level of debt and have few assets.

Bankruptcy

Bankruptcy

Is a legal process through which people or other entities who can not repay debts to creditor.

Trust Deed

Trust Deed

A trust deed is a voluntary agreement between you and creditors, Scotland residents only.

Consumers Choice is an independent website and has no association with the Government. You are welcome to act upon any options discussed and you are under no-obligation to accept the recommendations you may receive from our regulated partners. Fees apply. Your credit rating may be affected

This website is not part of the Facebook website or Facebook Inc. Additionally, this site is NOT endorsed by Facebook in any way.

DEBT PLANS

- Debt Management Plan

- Individual Voluntary Arrangement

- Trust Deed

- Debt Relief Order (DRO)

- Debt Arrangement Scheme

- Bankruptcy

- Sequestration

- Debt Consolidation Loan

The Money Helper is an impartial service set up by the Government to help people manage their money. To find out more about free debt advice, debt counselling, debt adjustment and credit information services,

PRIVACY POLICY

Social Links

Consumerschoice.co.uk is an independent website, created to put consumers in touch with FCA-authorised debt management companies and Insolvency Practitioners in the UK. We are a lead generator only, we do not provide debt advice or debt solutions. Our service is 100% free to consumers.

The regulated third parties we work with will assess your circumstances and provide you with tailored advice on a range of debt solutions including; debt management plans (DMP), individual voluntary arrangements (IVA), trust deeds, bankruptcy, debt relief orders (DRO), full and final settlements and more.

Our mission is to provide options to those in financial distress, offering them practical and ethical solutions to assist them in making the right Financial Choices moving forwards. We believe in treating every client with respect and dignity, ensuring fairness and support for all. we are committed to delivering exceptional services. We aim to exceed expectations, making a positive impact on consumers' knowledge. At Consumers Choice, we help our clients towards a brighter financial future, helping them navigate the stormy seas.

Consumers Choice is a trading style of Diamond Data Solutions Limited. Registered in England and Wales.

Registered Office: 35 Stanford New Road Altrincham. Co Reg No 09052376. ico za785650

Copyright © 2024 | Consumerschoice.co.uk. All rights reserved.